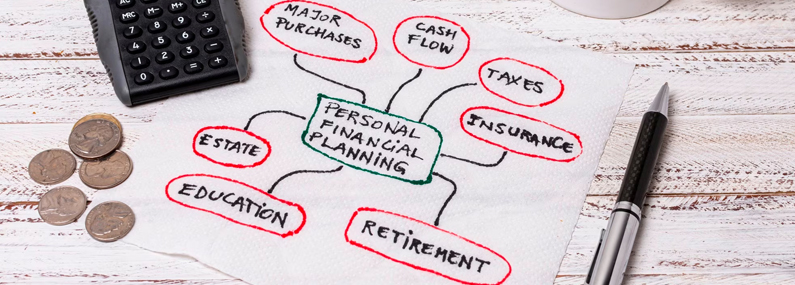

Major life transitions like getting married, having kids, buying a house, or establishing a business can drastically alter our lives. These changes require careful planning and financial preparation, even though they might be thrilling. A recent survey states that more than 69% of Indian households struggle with financial insecurity. It explains why financial planning is becoming more popular nowadays.

In this definitive guide, we’ll explore how to prepare financially for significant life events, the value of setting goals and creating a long-term financial plan. We will also explore common roadblocks to financial planning, practical examples of effective financial planning techniques, and the effect of financial planning on one’s ability to succeed and maintain financial stability.

Strategies for Financial Planning for Major Life Events

Creating a thorough plan that considers your current financial state, future financial goals, and the potential financial effects of big life events are required for financial planning for major life events. Financial planning is integral to our lives, particularly when preparing for major life events such as marriage, children, or retirement. These events need meticulous planning and preparation to guarantee that you have the necessary financial resources to fulfil your objectives.

01. Marriage

Marriage is a big life event that can substantially impact your life savings. Some people opt for a small wedding, while others go big. Budgeting for either path becomes essential. Moreover, when you get married, your finances are merged with your spouse’s, so it’s important to be prepared for the financial changes resulting from this decision. Here are some techniques for marriage financial planning:

- Create a Budget: Consider your income and spending with your partner. It will help you successfully manage your funds and avoid financial surprises.

- Discuss Your Financial Goals: Discuss your financial objectives with your partner and devise a strategy for achieving them. Whether saving for a house, planning annual trips abroad, or preparing for retirement, a common goal can help you remain on track.

02. Children

Raising children is a huge financial commitment, and it is critical to budget for the additional costs of raising a family. These are some financial planning techniques for children:

- Create a childcare budget: Childcare might be one of the largest costs associated with having a family. Establish a budget that includes the cost of daycare, babysitters, and other forms of child care.

- Make a budget for educational expenses: As your children grow older, you must consider their educational costs. Start saving early for college and other postsecondary fees.

- Consider life insurance: Life insurance is a crucial factor for parents. Life insurance can offer financial stability for your children and family in an unforeseen tragedy.

03. Retirement

Retirement is a major life event, marking your life after work. Since you will not have a regular income stream in your bank account every month, financial planning for a comfortable retirement is wise. As per the PGIM survey, more than 49% of Indians have made plans for their retirement. These are some techniques for retirement financial planning:

- Start saving early: The earlier you begin retirement savings, the better off you will be. Start saving to a retirement account immediately to avoid last-minute panic.

- Assess your retirement goals: Consider your retirement objectives and the money necessary. Consider factors such as healthcare costs, vacation, and lifestyle while developing a strategy for retirement.

- Get professional advice: Planning for retirement can be challenging, so it is vital to seek professional guidance. Consider collaborating with the best financial advisers locally who can assist you in developing a customised retirement plan.

Tactics for Efficient Money Management

The following are some tactics for efficient money management:

- Develop a Budget: Creating a budget is the foundation of financial planning. It helps you track your expenses and income and identify areas where you can reduce spending.

- Prioritise Debt Repayment: Paying off high-interest debt should be a top priority in your financial plan. It can help you save money on interest payments and improve your credit score.

- Build an Emergency Fund: An emergency fund can help you deal with unexpected expenses such as medical bills or job loss.

- Invest for the Long-term: Investing in stocks, bonds, and other assets can help you grow your wealth over time. It is important to have a diversified portfolio that matches your risk tolerance and financial goals.

Importance of Setting Financial Goals and Developing a Long-Term Financial Plan

Setting financial goals and creating a long-term plan is essential to financial stability and success. Your financial objectives should be SMART (specific, measurable, attainable, relevant, and time-bound). A long-term financial plan should consider your present financial state, future financial objectives, and the possible financial effect of important life events. It should comprise savings, debt payback, investment, and retirement strategies.

- Keeps You Focused: You have a clear financial goal when you have a financial plan. Financial goals give you something to strive towards, and a long-term strategy helps you stay on track. With a strategy in place, you are less likely to be sidetracked by short-term financial issues and can instead concentrate on reaching your objectives.

- Offers Financial Security: A long-term financial strategy helps develop financial security. By saving and investing, it is possible to build a nest egg that may be used to cover unforeseen bills or crises. You will also have a strategy in place to guarantee you have sufficient funds for a comfortable retirement.

- Encourages Sound Financial Habits: In achieving sound financial stability and success, it is essential to instil healthy financial habits. Developing a long-term financial plan is the cornerstone of healthy financial practices. It includes developing a budget, which is crucial for good financial management.

- Provides Financial Advice: Developing a long-term financial strategy might be difficult if you lack experience with financial planning, leading you to turn to financial experts. By getting financial advice, you can receive guidance on constructing a strategy that fits your financial circumstances. The best financial advisor will assist you with comprehending your financial objectives, creating a budget, and selecting the best investment alternatives.

Overcoming Common Obstacles to Financial Planning

There are several common obstacles to financial planning, including lack of financial knowledge, procrastination, and fear of the unknown. Overcoming these obstacles requires taking action and seeking professional financial advice. A financial advisor can provide expert advice and guidance on financial planning and analysis and help you develop a customised financial plan that meets your unique needs.

- Address Your Debt: One of the greatest obstacles to financial planning is debt. It may be intimidating and difficult to determine where to begin. Yet, if you wish to reach your financial objectives, you must handle your debt. Consider consolidation options to help you pay off your debt more quickly.

- Prioritise Your Expenses: When resources are limited, it is vital to prioritise costs. Create a list of your necessary costs, such as housing, food, and transportation, and reduce your discretionary spending on dining out and entertainment. Additionally, try negotiating your mobile phone and Wi-Fi costs to save money on network connections.

- Establish Achievable Goals: Financial problems might make it difficult to maintain motivation, but defining attainable objectives can help. Divide your objectives into smaller, more manageable steps, and applaud each achievement. This will assist you in maintaining motivation and concentrating on your long-term financial goal.

Impact Of Financial Planning on Personal Financial Stability and Success

Effective financial planning can have a significant impact on personal financial stability and success. It can assist you achieve your financial goals, prepare for unexpected expenses, and minimise financial stress. It can also help you make informed decisions about major life events such as buying a home, starting a family, or retiring.

- Better Financial Habits: Financial planning requires the creation of a budget, the tracking of spending, and the development of saving habits. These practices can help individuals become more financially responsible and eliminate unnecessary expenditures. You may establish a solid financial foundation for the future and avoid debt and overspending by creating healthy financial habits.

- Boosted Savings and Investments: Financial planning’s major objective is to enhance savings and investments. This can help individuals accumulate money and realise their long-term financial objectives. Individuals may use compound interest and increase their wealth over time by making a budget and allocating some of their income to savings and investments. When you receive interest or dividends from an investment, reinvesting this money can help compound the returns over time, substantially increasing your investment portfolio over the long run.

- Reduced Financial Strain: Financial stress may negatively influence your general health and quality of life. Creating a clear plan for managing finances, lowering debt, and accumulating savings through financial planning helps minimise financial stress. If you have a strategy, you might feel more in control of your finances and experience less stress due to financial uncertainty.

- Improved Decision-Making: Financial planning includes making educated choices on spending, saving, and investing. Individuals may make better financial decisions by examining and weighing various financial alternatives’ possible risks and benefits. This can assist them in avoiding costly errors and achieving their financial objectives more effectively.

- Improved Credit Score: Planning your finances might also positively affect your credit score. You may gradually improve your credit scores by establishing a strategy to minimise debt and make timely payments. A strong credit score helps you qualify for low-interest rates on loans, ultimately saving money.

- Increased Financial Security: Financial planning may provide individuals and families with financial stability. Individuals may prepare for unanticipated catastrophes and ensure they have the financial means to withstand any uncertainty by establishing an emergency fund, purchasing life insurance, and planning for retirement.

Final Takeaways

Financial planning for major life events is essential for achieving personal financial stability and success. Developing a comprehensive financial plan that takes into account your current financial situation, future financial goals, and the potential impact of major life events on your finances can help you make informed decisions and achieve your financial goals. Seeking professional assistance from financial advisors and debt management services can help overcome common obstacles to financial planning and ensure that you have the best financial advice and strategies to manage your finances effectively.